Emailing Expired Users

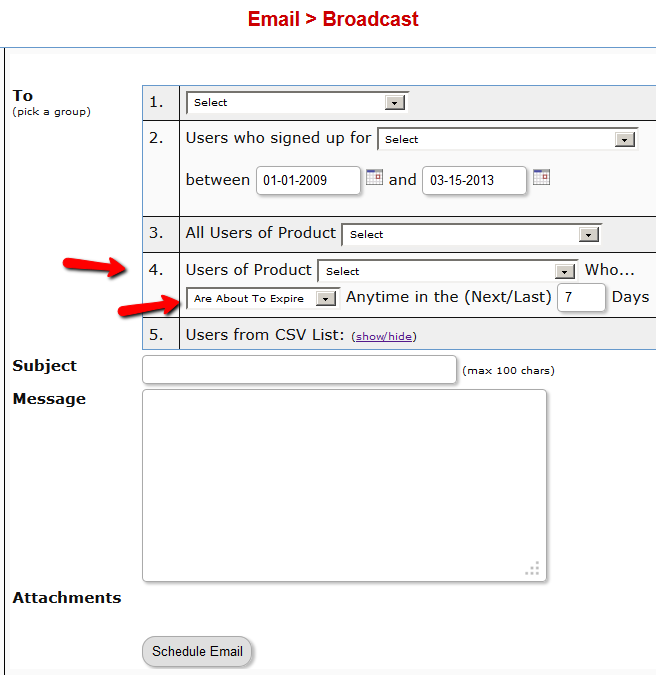

You can send an email broadcast to expired users of a product/level, on the DAP Admin > Email > Broadcasts page, by selecting Group #4.

The same feature works for sending emails to those who have “Cancelled” their subscription or trial.

Go to DAP Admin > Email > Broadcasts

Select Group #4.

1st drop-down: Select Product Name

2nd drop-down: Select “Have Already Expired”

3rd text field: Enter within how many days the users should’ve expired – as in, expired in the “Last X Days”

Once you’ve scheduled the broadcast, the emails will be sent out at the top of the hour when the DAP hourly cron runs.

Group Memberships And Sub-Accounts

So you want to use DAP to sell group memberships or sub-accounts.

Eg. 1) A group membership – or multi-user account – that a School/College/Teacher can buy on behalf of their students. It’s either a one-time product, or could be a subscription product. In that case, buyer keeps paying monthly, and when they stop paying, all sub-users (child accounts) get disabled.

Eg. 2) Company A pays $X for up to 20 of its employees to have individual memberships. To begin with, the money is collected in one lump sum and DAP grants 20 memberships. Then each month Company A pays the Corporate/Umbrella/Bulk Membership and DAP gives credit to the individual memberships. If Company A fails to pay, all the “sub” members underneath lose access.

How To Implement Group/Bulk Memberships

DAP doesn’t directly support sub-memberships or sub-accounts yet. We already have this on our humongous to-do list :-). And we definitely plan on implementing it soon. But for now, here’s a work-around for making this happen. It’s fairly simple, yet it is manual, and cannot be automated yet.

- You would set up a One-Time product in DAP called, say, “20-Seat Membership“. If you wish to sell different quantities of “seats” or “licenses”, then you have to create as many products (like “5 Seats”, “10 seats”, “50 seats”, etc).

- In the welcome email, you would instruct buyer to email you a CSV file with 20 (or as many as your product allows) names and email id’s, one per line, in this format (EMAIL,FIRST,LAST):student@gmail.com,John,Student

another@yahoo,com,Jill,Freshman

…

…

member20@yahoo,com,Joe,Senior - And then, using DAP’s bulk-import feature, in one fell-swoop, you can add all 20/50/100 to your membership site and give them all their own accounts, usernames and passwords, that they can all use to independently log in to your web site.

- If you see Step 1 above, we advised to make this a One-Time product. The reason for that, is you give life-time access first, and if they stop paying, then you cancel manually. So if the main buyer stops paying the subscription, this is the only time you will have some manual work hunting searching for those 20/50/100 email id’s on the Users > Manage page, and then clicking on “Remove” on their user row, so that they completely lose access.

Until we include this feature in DAP and make it automated, there are two ways to look at this.

One: You could say, it’s too much work to remove 20/50 emails when the main buyer cancels. OR…

Two: Since this is a group membership, you are hopefully charging them a good fee for this (if not, then you certainly should!). So you can always hire someone for $5 or $10 per hour on Odesk and have them do the removal of those email id’s. Removing 50 email id’s would take about 20 minutes at most. And you would need to do this only when they cancel, which can happen only once per group membership.

So hope that helps give you some ideas.

Hope this makes sense.

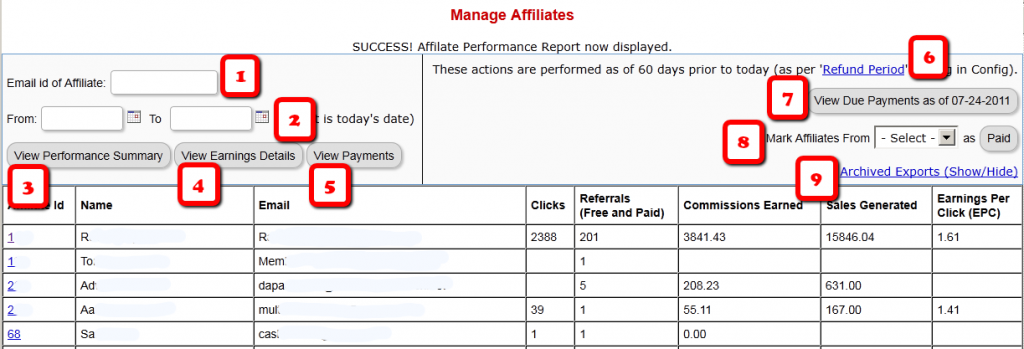

Affiliate Reports

DAP offers a number of affiliate statistics on the “Affiliates > Reports” page.

Here’s how it looks as of DAP v4.2.1.

1) Email Id of Affiliate

This is the field where you would enter the email id of an affiliate, if you want to generate a report specifically for an affiliate. If you leave it blank, the report will include all affiliates.

2) “From” & “To” Dates

By default, if you leave these fields blank, then DAP will assume “today’s” date – i.e., the date whenever you’re viewing this page.

3) View Performance Summary

This is the most detailed report available. This is the report being viewed in the above screenshot. For a given time period, for a given number of affiliates (“all” affiliates if (1) is left blank above), it shows…

- Affiliate Id

- Full Name

- Email id

- Clicks generated during selected period

- Referrals generated (includes total of both Free and Paid referrals): If the referred member actually bought something, it constitutes a “Paid” referral. If they simply signed up, say, for your free newsletter or free report or free product, then it is counted as a “Free” referral.

- Commissions Earned: This is the actual amount credited to the affiliate’s account during the selected period

- Sales Generated: This is the amount of the actual sale (purchase) generated for your membership site.

- Earnings Per Click (EPC): This is an indicator of how well your web site is converting clicks into signups/members. So if an affiliate sent you 100 clicks (on their affiliate link), and 5% of them signed up for your “FaceBook Secrets” membership product by paying $10 each, it means a total revenue of $10 x 5 = $50. And if you were paying 30% affiliate commissions for the product, then the affiliate earned $15 in total.Total clicks sent: 100

Total affiliate earnings from those 100 clicks: $15

Earnings Per Click (EPC) = $15/100 = $0.15 – which means, 15 cents per click.The higher the EPC, the easier it will be for you to attract other JV partners and super-affiliates.

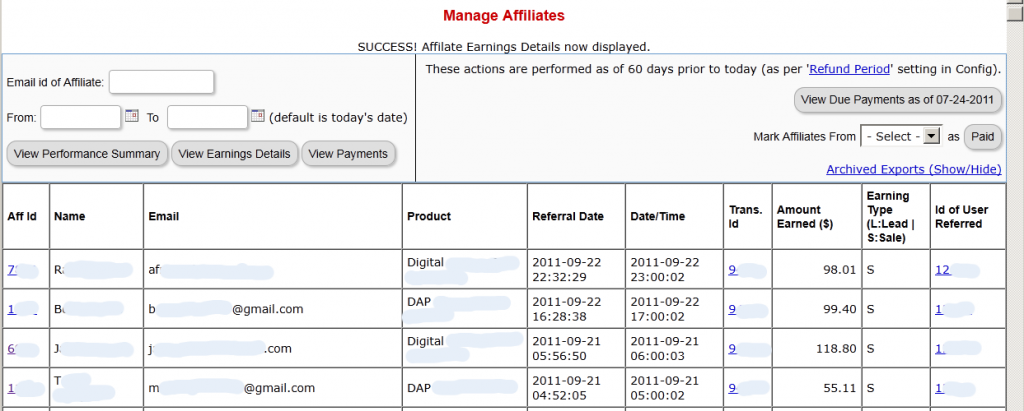

4) View Earnings Details

This shows the breakdown of each purchase referred by each affiliate. It’s a detailed view of the affiliate earnings, that lists each and every transaction (order) in the system that was referred by affiliates, all generated for the selected time period. It displays…

- Affiliate Id

- Full Name

- Email Id

- Product (name) that was purchased by referred buyer

- Referral Date (when affiliate was associated with buyer)

- Date/Time of actual transaction

- Trans Id: This is the transaction (order) id for the actual purchase

- Earning Type (L: Lead, S: Sale): Says what type of a commission credit it was – whether it was a “Pay Per Sale” credit or a “Pay Per Lead” credit.

- Id of User Referred: This tells you the actual user id of the buyer who was referred by the affiliate.

5) View Payments

This shows all payments made to affiliates during the period.

6) Refund Period

This is a config setting that you can change in Setup > Config. This is what drives which orders are picked up for affiliate payment. See this article for more details.

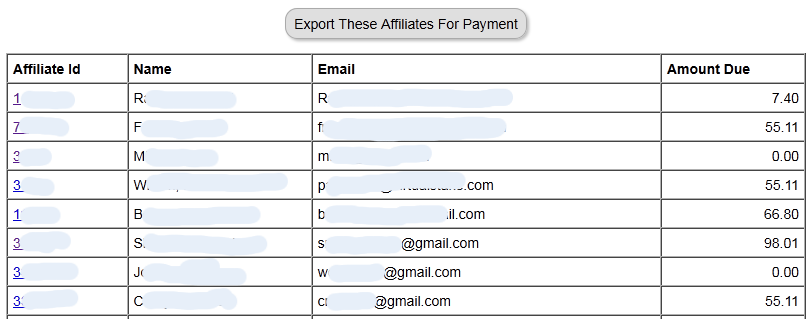

7) View Due Payments as of <date>

This is the MAIN button you should click to start the process of paying your affiliates each month (or however often it is that you pay affiliates). When you click this button, it will show you a report (see screenshot below) of commissions owed on all orders in the system UNTIL X days ago, where X is your “Refund Period”.

So if today is 10/01/2011, and you have a refund period of 60 days, then DAP will only consider orders prior to 60 days as of today. Which means, orders up to 08/01/2011 (of course, depending on how many days in a month, you may not exactly end up with 08/01/2011, because it goes an actual 60 days back from today – and sometimes, the report will stop at the 2nd or 3rd day of the month – like 08/03/2011. But that’s ok, don’t worry about it). You just focus on paying your affiliates on whatever day you wish to make the payment.

So when you click on this button, DAP will bring you a summary report of all affiliates, and how much they’re owed today, for all transactions referred by them as of 08/01/2011 (as per this example).

And when you click on the “Export These Affiliates For Payment” button shown in the screenshot above, DAP will select and mark those affiliates as being exported for payment.

And DAP will show you Paypal Mass-Pay Ready text report, with the affiliate info and the commission amount info already filled in and ready to go. If you’re paying via Paypal Mass-Pay, then all you need is this file. See this post for details.

NOTE: Being exported for payment doesn’t mean that you’ve actually paid them. Exporting affiliates for payment only means that DAP has now “set aside” those affiliates for payment, and you still need to tell DAP that you’ve actually paid your affiliates.

This is important, because you might export affiliates for payment on the first of the month, but it may take you a day or two (or 10) to actually make the payment – especially if you’re sending out Checks.

So once you’ve made the payment either through Paypal mass-pay, or by mailing your affiliates physical checks, then you need to tell DAP that you’ve actually sent out the payments, which is what you’ll do in the step below.

8 ) Mark Affiliates from <export> as Paid

This is where you will select the most recent export from the drop down (see #8 in first image at the very top), and click the “Paid” button. This is what actually lets DAP know that you’ve actually made the payment, and only after you do this, will the affiliates see the payment show up in the “Payments” section on their “Affiliate Info” page.

9) Archived Reports

This is just a report that shows you past commission payment exports.

DAP’s “Pause Membership” Feature

How It Works

Joe Member joins your site on 01/01/2011.

He stays a member for about 3 months. Let’s say it’s now mid March. He wants to take a couple of months break. So he goes on a 2 month break. Comes back end of May and wants to resume his membership.

DAP allows him to pick up right where he left off – which is continuing to receive content as of April (04/01/2011), even though today’s date is May 25th, 2011.

So while he took a break, other members who did not take a break in membership, continued to pay for those 2 months, and continued to receive content dripped through those months. So it is only fair that when he does come back end of May and resumes his subscription, he does not resume from June’s content, but from April’s content (when he last put his membership on “Pause”).

It’s ok if you’re not dripping content on a monthly-basis, but rather on a “day” basis. So to put it in terms of “days”, when Joe resumes his subscription, since he was already 90 days old in the system when he put his subscription “On Hold”, and comes back another 60 days later (roughly about 2 months), then DAP will start dripping Day #91 content onwards for him, and NOT Day #151 onwards (he didn’t pay for 2 months in between).

This is how DAP works right out of the box. Nothing special to configure. And DAP automatically takes care of pausing the dripping when he is not paying.

WARNING: Just remember that in order for you to put his actual payments on hold, you will need to have a payment gateway like Authorize.net or Paypal Website Payments Pro. Or you must be using a shopping cart like http://1SiteAutomation.com . Using something like Paypal Standard or ClickBank will not allow you to put the actual charging of his credit card on hold.

NOTE: If you actually did want him to start receiving current content even though he left for 2 months, then all you have to do is, once he comes back and starts paying again, just extend his access end date on his account (which will initially be showing 03/31/2011 – end of March, when he left) and modify it and make it 05/31/2011. So when his next payment comes in after he resumes, DAP will extend his access end date to 06/30/2011 – which means, he can now access all of the current content.

Recommended Refund Policy

There really is no one-size-fits-all when it comes to refund policies.

There are so many factors involved. The main one being, that Visa/Master/Amex/Paypal all give a buyer up to 60 days to ask for a refund, at least with most merchants.

Unless you’ve already negotiated the refund terms with your merchant account provider, and have both specifically agreed that there would be no refunds (like say, if you were selling an expensive item, like a car, or a boat, or a service), or that it’s only going to be a 30-day refund period, then you really have no control over the refund period. You just have to comply with at least the mandatory 60-day refund period required by the credit card companies.

So that brings us to the question:

How much should you set your refund period to be within DAP?

Now remember, it is this Refund Period setting (under Setup > Config > Advanced) that also makes affiliates eligible for payment.

So it really comes down to the question:

What is the waiting period for an affiliate to get paid for a referral?

Our recommendation: 60 days.

That’s because if you end up paying too soon (say like within 15 or 30 days), and then the buyer comes back and asks for a refund, now you’re out-of-pocket for the affiliate commissions that you have already paid on a purchase that you just refunded.

Now remember that when you do the actual refund within DAP, DAP will roll-back any commissions credited towards this purchase. If you have not yet paid your affiliates, then in the next report, it will ignore the refunded purchase, and will not calculate commissions on that purchase.

But if you have already paid your affiliates (like within 15 or 30 days after purchase), then DAP will include the negative commission in the next pay-period’s report. And any future commissions earned by this affiliate will be accordingly adjusted.

However, if the affiliate doesn’t refer any more members, then you have two choices at this point:

1) Ask the affiliate to pay back the over-paid commissions

2) Just swallow the loss, write it up to the cost of doing business, and move on.

Instant Affiliate Payments

There are some scripts out there that will allow you to “pay affiliates instantly”.

What this essentially means, is that the “seller email” in your Paypal button, is actually replaced with your affiliate’s Paypal email id. Which means the payment from your buyer is going straight into your affiliate’s Paypal account, not yours.

This means that when your buyer looks at her Paypal account, it does not say payment made to you “John Seller” (you), but to “Joe Affiliate” (your affiliate).

This is a poor business practice on so many levels.

1) Customer bought a product from you. Why is her Paypal account showing that she just made a payment of $97 to “Joe Affiliate”? Your customer is thinking, “Wait a minute… Who the heck is Joe Affiliate? I did not buy anything from any Joe Affiliate. Why is my Paypal account showing that I paid him money? HELP!… Fraud… Paypal Dispute… Scammer… I want a REFUND!”. Well, that’s what we would think too if we bought something from one merchant, and saw the payment going to someone else.

2) What happens when your customer wants a refund? Now you’re going to have to ask Joe Affiliate to return the payment, because you never got it – he did. What if Joe Affiliate doesn’t respond on time? What if he doesn’t return the money on time? What if he doesn’t want to return it at all? Will you hold up your customer’s refund, or are you going to keep paying out of your pocket and “hope” that Joe Affiliate returns your payment to you this time, and not to the buyer, because you have already send the buyer their money back?

So yes, this is just bad for business. Not to forget, looks extremely unprofessional on your part too.

The only way to properly handle instant payments, is by using Paypal’s Adaptive Payments technology, which allows you to do something called “Chained Payments”. And using Chained Payments, your customer always pays YOU first. And you can set up a chain, so that as soon as their payment hits your Paypal account, Paypal in turn will instantly send a money from YOUR account to your AFFILIATE’s account. So Customer pays you, you pay the affiliate. And that’s how it should be.

Anything else will only get you in trouble with Paypal, maybe even get your account banned, piss your customers off, dilute your brand, your reputation may get trashed, and just about everything that is not good for your business could happen.

Now DAP does allow you to instantly ‘credit’ your affiliate’s account with the payment due, but you still have to push a couple of buttons before the affiliate can actually get paid.

And that’s how it’s going to be until we develop support for Paypal Adaptive Payments (which has its own complications, by the way).

What is your take on this? Feel free to leave your comments below.

DAP-Supported Shopping Carts

Last updated: 09/02/2014

Direct Integration with Shopping Carts and Payment Processors

UPDATE: We are now authorized resellers for Authorize.net. If you’re in the US or Canada, click here to apply. If you’re in the UK, then click here.

DAP directly integrates with the following Payment Processors without the need for any additional third-party shopping carts:

- Stripe (new!) – via DAP Shopping Cart

- Authorize.net (US/Canada / UK) – via DAP Shopping Cart

- 2Checkout.com

- CCBill.com

- ClickBank

- ClickBank PitchPlus (1-Click Upsells)

- Digiresults

- DealGuardian

- Google Checkout

- e-Junkie (FYI: e-J does not allow recurring payments)

- JVZoo

- Paypal Standard – direct & via DAP Shopping Cart

- Paypal Express Checkout – direct & via DAP Shopping Cart

- Paypal Website Payments Pro (legacy) – via DAP Shopping Cart

- Plimus

- WorldPay

- WSO Pro (Warrior Plus)

- Zaxaa

DAP also integrates with the following Shopping Carts

- 1SiteAutomation.com (a 1shoppingcart private label)

- InfusionSoft

- Nanacast

- Ontraport (prev. Office Auto Pilot)

- Premium Web Cart

- WooCommerce

- WP eStore

Indirect Integration through 3rd Party Shopping Carts

Since DAP integrates with Shopping carts like WooCommerc, 1SiteAutomation.com (our white label of 1Shoppingcart), e-Junkie, Premium Web Cart and Infusionsoft, that means that it also integrates (albeit indirectly) with all of the Payment processors and gateways that these carts support. So, for example, since DAP works with 1SiteAutomation, it essentially integrates with all payment providers supported by 1SiteAutomation, like:

Bank of America

BluePay

Concord EFSNet

Cybercash

DPI Merchant Services

e-Commerce Exchange

Echo Inc.

ECX QuickCommerce 3.0

Epoch Systems

eProcessing Network

EPS SecureNet

EWAY (Australia)

FastTransact

Firepay

GoRealTime/EPP

GoRealTime

iBill

IntelliPay ExpertLink

IONGate (Costco)

iTransact RediCharge

LinkPoint Secure

MCPS WebLink

MerchantPartners

Moneris

NETbilling

Network Merchants

Paradata

PayCom Processing

Paymentech (direct integration via Authorize.net)

PayPal Payflow Pro (via e-Junkie)

PayReady

Planet Payment

PRIGate

PSiGate

RightConnect

RTWare WebLink

Shift4

SkipJack

StrataPay

Surepay

TrialPay (via e-Junkie)

TrustCommerce

USAEpay

uSight

VeriPayment

VeriSign PayFlow Pro

ViaKlix (Nova Systems)

YourPay

For the full list and more details, click here

1-Click Upsells

If you use the DAP Shopping Cart Plugin, you can do 1-Click Upsells/Downsells like the pros, without the need for any external shopping cart or upsell service provider.

The free DAP shopping cart that comes with your DAP purchase allows you to do unlimited 1-Click Upsells using Stripe, Authorize.net and Paypal Website Payments Pro (legacy).

However, for doing 2-Click Upsells/Downsells with Paypal Standard, you need our Paypal Upsell-Tree plugin that is sold separately. Or you can also get this plugin for free with our Platinum subscription.

Of course, if you need advanced shopping cart features – like ability to calculate shipping, tax, and coupons – then you should consider using 1SiteAutomation.com.

1ShoppingCart & GoDaddy

If you want automated recurring order processing using 1ShoppingCart (1SC) or 1SiteAutomation.com, then DAP needs to be able to process the recurring email notifications sent by 1ShoppingCart, which it does on the back-end when the DAP Cron Job runs every 10 minutes.

However, if you’re using Godaddy as your web host, then because GoDaddy disables a mandatory PHP library (“imap”) on all their servers for some reason, DAP is unable to process the recurring order email notifications from 1ShoppingCart.

This is not an issue if you are using GoDaddy as just your domain name registrar, and using some other service like Liquid Web or Hostgator as your web host.

But if you’re using 1SC & GoDaddy hosting, you will have to end up doing manual cancellations if any member cancels their subscription, or if their credit card fails and their recurring payments don’t get processed.

Please note that 1ShoppingCart order processing works great with all other (non-GoDaddy) hosts.

Cancellation or Refund Requests

The Question

How does a customer, once they have signed up and become a member, cancel their membership (or get for a refund)?

Cancellations

If it’s Paypal, they could go into their Paypal account, and cancel their subscription themselves.

If it’s ClickBank, they can log in to their CB account, and cancel their subscription themselves.

If it’s any other payment processor or cart – like 1SiteAutomation.com, Authorize.net, Paypal Payments Pro, etc – then they have to ask you (the membership site owner) to cancel.

Refunds

Except with CB, in all other cases, they have to ask you for a refund

Action Steps For DAP Admin

Whether it’s a cancellation or a refund, log in to your Payment Processor (1shoppingcart, Authorize.net, etc), and make sure you perform the cancellation or refund there. DAP does not store any of the payment information of your subscriber. So both cancellations and refunds have to be performed at your Payment Processor.

Now that you’ve cancelled the actual charging of the customer at the payment processor level, you have to also take care of the customer within DAP – only for refunds.

Cancellation Of Ongoing Subscription in DAP

If this is the cancellation of an ongoing subscription, then no action required within the DAP Dashboard as far as the User is concerned. DAP already does “Pay As You Go” processing – which means, their account will automatically expire at the end of the current recurring period (eg., end of current month). The “Access End Date” of the user’s access to the Product will automatically expire if no new payments come in. And then they’ll automatically lose all access to the content that is part of that Product.

However, if this is the cancellation of a “trial”, where if the user comes back and signs up again for another trial a few weeks or months later, then you want the user to start all the way AT THE BEGINNING. So if it’s the cancellation of a “trial” then you must manually remove the user’s access to the product. So for that, follow the process below.

Refunds (and Cancellation of Trial) in DAP

If it’s a refund of the entire purchase, then…

- Search for that user by email on the “Orders” page, which will bring up their Order (a.k.a “Transaction”)

- Click on the “Refund” button on that screen. That will create a new negative transaction in the Orders table. Then it also roll-backs any affiliate commissions earned on that sale and make a negative entry in the database for that affiliate. Then it rolls back user access by the number of days entered in one of the “Recurring Cycles” entered on that Product’s page (depending on how far along they were in as a member).

- Now search for that user by email on the “Users > Manage” screen. Make sure that they no longer have access to the Product.

If it’s a refund of just one recurring payment from among a series of subscription payments, or the cancellation of a trial, then you can go into the “Users > Manage” screen, search for the user, and do a “Rollback Access for Selected User(s) to the Product by 1 Recurring Cycle“.

For a big-picture view, also see Cancellations & Refunds

Cancellations and Refunds

Cancellation Of Ongoing Subscription

DAP employs a very unique “Pay As You Go” model.

It’s very similar to the “Pay As You Go” model used by cell phone companies.

You pay first, then new content (or “cell phone minutes” in the mobile world) gets released to you. You stop paying, you don’t get new content (minutes).

So let’s say a member (Joe Customer) joined your membership site this month, and this is January. So he’s on Month #1 in January.

When he first signs up (free or paid trial, or actual 1st month’s subscription), then his start and end dates in DAP on your site look like this:

Start date: Jan 1, 2009

End date: Jan 31, 2009

(Of course, DAP uses actual dates like “01/01/2009”, but “Jan 1, 2009” is easier to read for most people, especially an international audience – so using the above date format just for the purposes of this post).

Then, let’s say, his February subscription payment comes in. Now DAP “extends” his access to your content by a month. So now the dates look like this:

Start date: Jan 1, 2009

End date: Feb 28, 2009

Now your member Joe has access to all content from Jan 1 to Feb 28 (meaning, about 60 days worth of “dripped content”).

Then end of February, he decides to cancel his membership for whatever reason (or his credit card gets declined or rejected while processing payment for Feb). So no payment comes in for March.

Now because no payment came in, DAP doesn’t really do anything about his access dates. So they continue to stay at:

Start date: Jan 1, 2009

End date: Feb 28, 2009

So any content that you have configured to be dripped on, say, Day #61 (which is Month #3), won’t be available to Joe, even though he continues to remain an “Active” member within DAP, and continues to get your autoresponder and br0adcast emails, and even continues to have access to your affiliate program and continues to earn commissions.

Actually, it gets even better – just because Joe’s end date expired, he basically now has NO access to ANY content on your web site (even Month #1’s content).

[Note: Just so you know, DAP does have a feature to enable “Access to Previously Paid-for Content”. Keep reading for details.]Now all Joe has lost is just the “access to the content”.

So let’s say you exchange emails with him, ask him why he wanted to cancel, and try to convince him to come back (or get him to use a new, valid credit card).

Now remember that Joe is still at the end of February’s content (Month #2). So whenever the next payment comes in (be it in March, April, or 1 year later), Joe now gets access only to the 3rd month’s content, and not, say, the 10th month content.

So even though it is now say, May, because Joe’s next payment came in just now, his access dates now look like this:

Start date: Jan 1, 2009

End date: March 31, 2009

So that’s how DAP takes care of your content and makes sure that when members cancel or their payment doesn’t come in for whatever reason, your content cannot be accessed by unauthorized users.

But let’s say you want to be really fair and look like a “generous, honest” guy to your members. In that case, you want to make sure that if someone cancels their subscription 6 months after being with you, you don’t want to ‘screw’ them just because they stopped paying you. Who knows, they’ll probably come back if you keep showing to them what kind of content you’re building. Or they may buy your other products.

So now you want to make sure that they get access to the last 6 months worth of content, for which they have actually paid for.

There is a Configuration element in DAP where you can just turn this feature on, and members can instantly start access all “Previously Paid-for Content”.

So that’s how DAP puts a unique twist on cancellations.

Cancellation Of Trial

There is a small twist to the cancellation of a free or paid “Trial”. Consider the following example:

- User made the purchase on 2011-09-16.

- Because you have set it up as a 14-day trial, User gets 14 days of access.

So at this time the user’s access start date = 2011-09-16 and user’s access end date = 2011-09-29 (14 days access). - He then asks you to cancel his trial. So you go into your payment processor back-office, and cancel his future payments.

- In this case, because it’s a “trial”, if he ever decides to come back down the road and sign up for a trial again, you need him to start all the way AT THE BEGINNING.

- Which means, you must completely remove this person’s access to the product in DAP.

- If you don’t do it, then if he does come back later, then DAP will think he’s an existing user who wants to RESUME his subscription, and will move him past the trial into the next payment period meant only for people who actually stayed past the trial.

Refunds

“Refunds” are a slightly different animal than “Cancellations”. While a subscription “Cancellation” means you only have to stop access going forward, a “Refund” means you have to actually roll-back existing access.

So, doing a refund takes a few steps.

- Go into your payment processor (like Paypal.com, Authorize.net, etc) and refund the actual payment

- Now log into the DAP Dashboard on your site

- Go to the “Orders” page, search for all of the user’s transactions by her email id

- Click on the “Id” link for the transaction that you wish to refund

- On the transaction details page, you will see a “Refund” button. Click on that.

- That will mark that transaction as a refund, and also create a new transaction with a negative value (same as value of original transaction, except negative in value)

- DAP then rolls-back access for that user by one payment period (or “Recurring Cycle #3” from the Product page). So if member is still in month 1, then user will lose complete access to the product. But if member is on month 3, then since only one payment is being refunded, only the last month’s access (month #3’s access) will be rolled back – so now they only have access till month 2.

- Go back to “Manage > Users” screen, search for user by email, and make sure access is either rolled back, or access has been completely removed for that member.

- All Affiliate commissions credited to affiliates for this particular purchase will be automatically and completely rolled back. So the affiliate who referred this purchase, will see a negative commission credited to their account, that cancels out the positive commission credited earlier. So that in effect zeroes out their commissions.

DAP’s Incredibly Powerful Affiliate Program

DAP offers you a built-in Affiliate Program for your web site, where all your Members can automatically and instantly be enrolled as Affiliates.

And here are a few, rare and powerful features in DAP, that you won’t find in most other affiliate providers:

1) Instant Affiliates

This means that as soon as a buyer purchases any product, or even signs up for a free product, they can get an instant affiliate link that they can immediately start using to promote your membership site.

In fact, you can even send them their own unique affiliate link right in their welcome email itself, the same email where you send them their login info! So even before they’ve logged in to your site to download or view the content that they’ve just purchased, they’re already and affiliate and can start promoting your site to others, and earn back their investment even before they’ve reached your refund period.

2) Global Affiliate Link

There’s just one “core” (default) affiliate link that your affiliates can use to promote your web site, and regardless of which product the referral ends up buying, your affiliate gets paid on all of those purchased products.

So it’s like an Amazon affiliate link. One global link that gets you paid on any resulting purchases. So your specific affiliate link could be promoting a book, electronic gadget, shoe or clothing. And once your referral gets to Amazon.com after clicking your affiliate link, even if they don’t purchase that specific product that you just them to, and go on to purchase ANY other product from the entire Amazon.com catalog (which are commission-eligible, of course), then you’ll make commissions on any resulting sale. That’s exactly how the DAP affiliate program works too. Just one default affiliate link. Affiliate can redirect visitor to any landing page (see details below), and affiliate gets paid for any resulting sales.

3) Affiliate Link Redirection

Let’s say you were an Affiliate of Amazon.com. Now imagine if Amazon gave you just one, static affiliate link to promote ALL of their products across their ENTIRE web site. That is, one standard affiliate link to promote millions of products, and anyone who clicked on that standard link would always land at Amazon’s home page, no matter what – and that there was no way to direct affiliate traffic directly to any of the actual product pages.

Imagine if you saw a link on our blog that read “Click here to check out the amazing Bamboo Fun tablet” and the link, instead of taking you directly to the product page of the Bamboo fun, took you to Amazon’s home page? How incredibly annoying would that be for the visitor to always be taken to Amazon’s home page no matter what product someone were recommending? Think Amazon would be the e-commerce juggernaut it is today without that implementing that simple feature?

But Amazon lets you link directly to the product pages of the product you are referring to (or recommending, or promoting).

Like….

“Check out the amazing Bamboo Fun tablet” (links directly to product page)

“Check out my best-selling book ‘No Business Like E-Business’ on Amazon” (links directly to the book page)

We are amazed that so many affiliate software providers do not offer this simple, basic feature. And that is the ability to set the affiliate cookie, and then redirect the referred visitor to any page on any web site the affiliate wants the visitor to land on.

So when you use DAP, your affiliates are not forced to always send traffic to your home page. They can redirect the visitor (who just clicked on their affiliate link) to any part of your web site. In fact, they can redirect the visitor to any web page on any web site anywhere online! So they could be sending traffic to one of your free videos, one of your blog posts, or even to one of your articles published on someone else’s web site!

3) Multi-Tier Affiliate Program

DAP allows you to offer multiple tiers of commissions, not just one. So you can create an incredible revenue stream for your affiliates, where they get paid on the sales generated by their 1st level referrals. Which means more incentive for them to join and promote your affiliate program!

4) Paying A Per-Lead Commission To Your ClickBank Affiliates

You already know that DAP supports ClickBank purchases, and you can turn off the display of your affiliate section if you are using ClickBank’s own affiliate program, instead of DAP.

But wait – that does not mean that you can’t use the two affiliate programs IN TANDEM to pull of something really crazy – like awarding your ClickBank affiliates with a commission just for sending you a lead – meaning, the lead just signs up for your “free” newsletter – and of course, if they go on to purchase something from your web site (assuming you are selling through ClickBank), then they get the usual CB commissions.

So here’s how it works:

- Every member on your DAP-powered site gets their own affiliate link that looks like:

http://YourSite.com/dap/a/?a=1234 - And their CB affiliate link for your product would look like

http://affnick.merchantnick.hop.clickbank.net - Now DAP’s affiliate link has the capability of redirecting to any page on your site (or any page on any web site) by adding the destination URL to the affiliate link.

- So, now your affiliate adds their CB affiliate link to the END of their DAP affiliate link, like this:

http://YourSite.com/dap/a/?a=1234&p=http://affnick.merchantnick.hop.clickbank.net - So when someone clicks on this above link that your affiliate is promoting, then two things happen:

a) The DAP affiliate cookie is set

b) The CB cookie is also set - So within DAP, you can set up just a Per-Lead Affiliate Commission for your Product (which is say, a free newsletter or a free PDF, or whatever)

- So when the referred user signs up at your membership site, they first get paid the Per-Lead Commission

- If they then go on to purchase other products from your web site (which obviously you’re selling through ClickBank, otherwise, this whole section is of no meaning to you), then they get the Per-Sale commission from ClickBank too!

So that sums up some of the best features that are part of DAP.

Other Built-In Affiliate Features

Of course, there’s still all the other cool affiliate features in DAP, like…

- Commission Override: Give special treatment to your Top Affiliates and JV partners by giving them higher commissions than the rest of your affiliates.

- Pay affiliates both one-time or monthly recurring commissions for the life of the subscriber.

- Pay-Per-Lead and Pay-Per-Sale

- Ready-made Affiliate Links Displayed for Users

- Ready-made Affiliate Toolbox for your affiliates

- Affiliate-Analytics:

* Real-time Earnings Reporting

* Real-time Payment Report

* Real-time Traffic Stats for both Affiliates and Admin (with referers) - Paypal Mass-Pay Ready: You get a Paypal Mass-Pay ready, fully formatted affiliate list with all commissions listed.

- Offline Payments: Export Affiliates for payment, pay them using any offline means (eg., checks), and then once the checks have been mailed, you can mark them all as “Paid”.

- Process Refund for Affiliates: When you process a refund, DAP will also reverse the affiliate commission. It will not reverse the Pay-per-lead amounts. Only the Pay-per-sale amount is negated.

So these are the features available to right out-of-the-box, just waiting for you to start signing up an army of affiliates from day 1!

For more information about the Affiliate Module, check out our documentation page at http://DigitalAccessPass.com/documentation/ and see the